|

Introduction to SET50 Index Futures

A SET50 Index Futures contract consists of two important components—a futures contract and the SET50 index. The combination of these two components creates a futures contract with the SET50 as the underlying asset.

Characteristics and Specifications of SET50 Index Futures

TFEX has defined the characteristics and specifications for SET50 Index Futures, as follow:

| Heading |

Individual Contract Specification |

| Underlying Asset |

SET50 Index which is compiled, computed and announced by the Stock Exchange of Thailand |

| Contract Size |

Bt1,000 per index point |

| Contract Months |

March, June, September, December up to 4 quarters |

| Tick size |

0.10 index points |

| Ceiling/Floor |

+ / - 30% of previous settlement price |

| Trading Hours |

Pre-open: 9:15 - 9:45 hrs

Morning session: 9:45 - 2:30 hrs

Pre-open: 14:00 - 14:30hrs

Afternoon session: 14:30 - 16:55 hrs |

| Speculative Position Limit |

Net 20,000 delta equivalent SET50 Index Futures contracts on one side of the market in any contract month or all contract months combined |

| Last Trading Day |

The day prior to the last exchange business day of the contract month. Time at which trading ceases on the Last Trading Day is 16.30 hrs |

| Final Settlement Price |

The numerical value of the SET50 Index, rounded down to the nearest two decimal points as determined by the exchange, and shall be the average value of the SET50 Index taken during the last 15 minutes plus the closing index value, excluding the three highest and three lowest values |

| Settlement |

Cash Settlement |

Underlying Asset

The underlying asset of a SET50 Index futures contract is the SET50 Index. The index value is calculated from the market value of the top 50 stocks compiled and announced by the Stock Exchange of Thailand. The calculation used is the Market Capitalization Weight Method.

Contract Multiplier

The index multiplier for a SET50 Index Futures contract is equal to Bt1,000 per 1 index point. That means if the index trades at 300 points, the value of the contract will be 300 x 1,000 = Bt300,000.

Contract Months

The TFEX has set the contract months (delivery months) of SET50 Index Futures as the last month of each quarter—March, June, September and December. For example, if today is November 24, 2008, the outstanding futures contracts being traded will be for the following contract months only:

- December 2008

- March 2009

- June 2009

- September 2009

However, on the last trading day of the nearest contract, a new further contract will be opened for trading. Assuming that today is the last trading day for the contracts expiring in Dec 2008, a new contract expiring in Dec 2009 will automatically be opened for trading.

Tick size

The tick size for a SET50 Index Futures contract equals 0.1 of an index point. That means that the price difference between each order cannot be less than 0.1

- Examples of valid price ranges are 300 points, 300.1 points and 299.5 points.

- Examples of invalid price ranges are 300.11 points, 300.25 points and 299.99 points.

Ceiling/Floor

The TFEX has set the daily ceiling and floor for SET50 Index Futures. The ceiling is 30% above the previous day’s settlement price; the floor is 30% below the previous day’s settlement price. For example if the settlement price on the previous day is equal to 300 points, the price that the contract can be traded may not be higher than 390 points and may not be lower than 210 points.

For a Combination order, the ceiling and floor are set using the previous day’s settlement price of the far month minus previous day’s settlement price of the near month (Far-Near). The ceiling is equal to the spread of the previous day’s settlement price of the far–near month +10.0, while the floor is equal that spread -10.0.

Trading hours

The trading day is divided into four sessions

Session |

Details |

Periods |

1 |

Pre-open |

9:15 – 9:45 |

2 |

Morning session |

9:45 – 12:30 |

3 |

Pre-open |

14:00 – 14:30 |

4 |

Afternoon session |

14:30 – 16:55 |

Last Trading Day

The last trading day of each contract is the day prior to the last exchange business day in the contract month. Examples are as follow:

Expirations |

Last trading days |

December 2008 |

29 December 2008 |

March 2009 |

30 March 2009 |

June 2009 |

29 June 2009 |

September 2009 |

29 September 2009 |

December 2009 |

29 December 2009 |

Note also that on every last trading day the contract can be traded only until 16.30 hrs.

Final Settlement Price

The price comes from the average value of the SET50 Index on the last trading day of the futures contract. It is calculated from the SET50 index on a minute-by-minute basis during the last 15 minutes before trading ends, starting from 16:15 hrs through to 16:30 hrs and the close value of the index on that day. The three highest and three lowest values are excluded from the sample and two decimal points used for rounding the number of the average.

Cash Settlement

For the sake of convenience, there is no physical delivery of a futures contract of the SET50 index. Only cash settlement will be made. Gains and losses from the contract’s position will result in cash transfers to the customer’s account. When a contract is settled in cash, its position will be declared closed.

Contract Code

Single Order

The contract code for a single order of a SET50 Index Futures contract comprises three parts, as shown below.

Part 1 |

Part 2 |

Part 3 |

S50 |

Z |

09 |

Part 1: Underlying Asset

The SET50 index is the only underlying asset for an Index Futures contract—S50 is used as its symbol.

Part 2: Contract Month

The symbol of each expiry month is represented by a letter, see below

Contract Months |

Symbol |

March |

H |

June |

M |

September |

U |

December |

Z |

Part 3: Expiry Year

The last two digits of the expiry year are used—for example, 08 for contract expiry year 2008 and 09 for a contract due to expire in 2009.

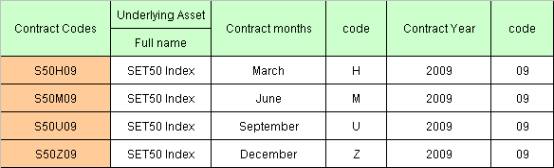

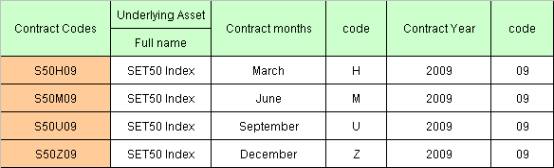

The contract codes for SET50 Index futures for all contract months can be found below.

Examples of contract codes for SET50 Index Futures using a Single Order

Examples of contract codes for SET50 Index Futures using Combination Orders

Combination Order

The contract code of a combination order for SET50 Index Futures comprises five parts, as follow:

Part 1 |

Part 2 |

Part 3 |

Part 4 |

Part 5 |

S50 |

U |

09 |

Z |

09 |

Part 1: Underlying Asset

As the SET50 index is the only underlying asset of an Index Futures contract, S50 is used as its symbol.

Part 2 and part 4: Expiry Months

Each expiry month is represented by a letter, see below

Expiry months |

Symbol |

March |

H |

June |

M |

September |

U |

December |

Z |

Part 3 and part 5: Expiry Year The last two digits of the respective expiry years are used—for example, 08 for contract expiry year 2008 and 09 for a contract due to expire in 2009.

Example of trading using a Combination Order

- An investor sends an order to buy S50U09Z09 at price 1 index point, which means the investor wants to buy S50Z09 and sell S50U09 simultaneously. The price of S50Z09

minus that of S50U09 must not exceed 1 index point.

- An investor sends an order to sell S50M09Z09 priced at two index points, which means the investor wants to sell S50Z09 and buy S50M09X simultaneously. The price of S50Z09 minus that of S50M09 must not be lower than 2 points.

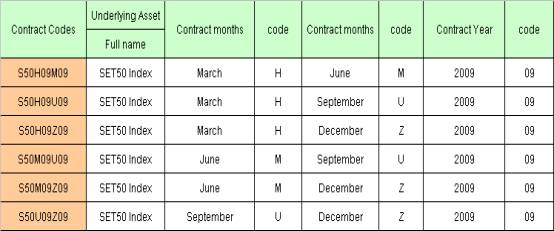

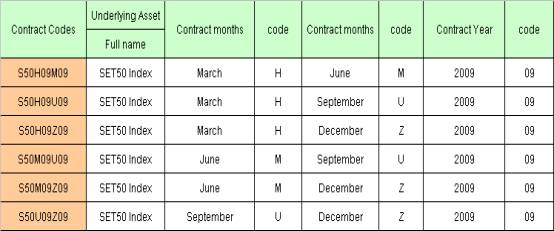

The contract codes of SET50 Index futures for all contract months can be found below.

Examples of contract codes for SET50 Index Futures using a Single Order

Examples of contract codes for SET50 Index Futures using Combination Orders

Circuit Breaker

Circuit Breaker of TFEX will be in line with that of SET. Therefore whenever the SET closes due to a circuit breaker, the TFEX will also close for trading.

Circuit Breaker in the SET will be announced according to the following conditions:

The first Circuit Breaker engages when the SET Index falls 10% below the previous day’s close. The SET stops trading for 30 minutes.

The second Circuit Breaker engages when the SET Index drops further to 20% below the previous day’s close. The SET stops trading for one hour.

After the second Circuit Breaker, the SET opens for trading until normal closing time without any further stop. In the case that the remaining trading time of the session is less than 30 minutes or 1 hour when the Circuit Breaker takes place, the SET will stop trading during that remaining time only.

Contract Holding till Expiration

A futures contract of the SET50 Index that is held till expiration will be marked-to-market at the end of the last trading day of that contract month. The investor will receive/pay the difference between the final cost and the final settlement price, while his/her position will be automatically closed.

Speculative Position Limit

The maximum number of contracts that a speculator may hold in both SET50 Index Futures and SET50 Index Options (calculated as equivalent to the position of SET50 Index Futures) is not more than 20,000 contracts in any one contract month or among all contract months combined.

Reportable Limit

As specified by the SEC and TFEX, all brokers must report name lists of clients that hold at least 500 contracts or equivalent in SET50 Index Futures and/or SET50 Index Options in any contract month or among all contract months combined. The contracts will be computed from one single contract month and net of all contract months. However, investors can still increase their net holding positions, so long as they do not exceed their authorized credit limits and do not exceed the speculative position limit, as set by the TFEX.

Trading Strategies

Directional Trading Strategy

A SET50 Index Futures contract is an instrument that can help investors profit in both bull and bear markets. This is due to the fact that the SET50 Index Futures contract does not need a physical transfer of any real asset, only a cash settlement, which is the process of receiving or paying the difference between the contract price and the final settlement price. As a result, investors can make the following transactions with convenience and efficiency:

- “Buy and sell ” in order to speculate on a market uptrend.

- “Short sell and buy back” in order to speculate on a market downtrend.

Spread Trading Strategies

Besides the directional trading, investors can also apply spread trading strategies that involve trading two futures contracts simultaneously. Three common spread trading strategies are as follow:

1. Calendar Spread

Strategy Components

The calendar spread or, in other words, inter-month spread is a strategy that consists of

- Long position in one futures contract

- Short position in one futures contract (the same underlying asset, but a different contract month).

For Example?

- Long S50U08 and short S50Z08 (Buy near, sell far)?

- Short S50M09 and long S50U09 (Buy far, sell near)?

Objectives and Strategies

- An investor is holding contracts with low liquidity and needs to close his positions.

Example On February 1, 2009 Mr A has a long position in S50Z09, but the SET index has dropped dramatically by that time, so he needs to close his position. However, the liquidity of S50Z09, which is the furthest month, is very low.

Therefore Mr A should take a short position either on S50H09 or S50M09 for a similar amount for hedging (stop loss), then he can close out the two contracts later when there is enough liquidity.

- An investor has a long position in a contract and would like to close his position. However, the contracts in other series are trading at much better prices.

Example On March 1, 2009, Mr A has a long position in S50M09 and wants to close his position as the contract price has increased significantly. However, the price of another contract series, such as S50U09, is much higher than the price of S50M09.

Therefore, Mr A should short S50U09 for the same amount in order to hedge his position (lock in the profit), then close the two contracts later when the price of S50M09 increases to the level of S50U09.

- Price Speculation

Example The price difference of S50Z09 – S50U09 now is equal to Bt2, but the investor expects the difference between the two contracts (S50Z09 – S50U09) to decline.

Therefore, the investor could short S50U09Z09 at Bt2 and close out his positions in the two contracts when the price difference (S50Z09 – S50U09) declines by taking a long position in S50U09Z09.

Tips

-

The transaction cost of this strategy is double that of a directional trading strategy.

- A combination order can be used with a calendar spread trading strategy.

2. Inter-Market Spread

Strategy Components

The inter-market spread consists of:

- Long position in X futures contract?

- Short position in Y futures contract (different underlying asset and type of market)?

The underlying assets for this strategy are those categorized in different types of markets, which can be referred to in Attachment 2.

Example

- Long S50Z09 and short ADVANZ09

- Short S50M09 and long PTTM09

Objectives of the strategy

The investor expects the return of one underlying asset to outperform that of another, which is of a different market type.

Example Mr A expects the return of the SET50 Index to outperform that of ADVANC. The difference between their price returns in percentage points will increase.

Therefore the investors can apply Inter-Market Spread by:

Long S50U09 at a price of 300.8 points for 1 contract

(total contract value is 300.8 x 1 x 1,000 = Bt300,800)

Short ADVANCU09 at a price of Bt75.9 for 4 contracts

(total contract value is 75.9 x 4 x 1,000 = Bt303,600)

In order to close the position, he can short S50U09 for one contract and long ADVANCU09 for four contracts.

Tips

- The transaction cost of this strategy is double that of a directional trading strategy.

- The combination order cannot be used with a calendar spread trading strategy.

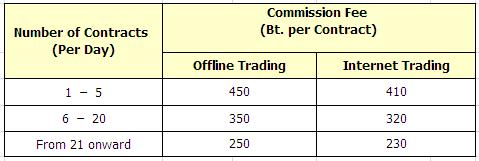

Commission fee The commission for SET50 Index Futures is fixed. The rates per contract, VAT exclusive, for offline and Internet trading are as follow:

Examples

- An investor buys 1 contract of S50Z11 via offline trading so the commission fee (VAT exclusive) is equal to Bt450.

- An investor buys 1 contract of S50Z11 via Internet trading so the commission fee (VAT exclusive) is equal to Bt410.

- An investor buys 10 contracts of S50Z11 via offline trading so the commission fee (VAT exclusive) is equal to 350 x 10 = Bt3,500.

- An investor buys 10 contracts of S50Z11 via Internet trading so the commission fee (VAT exclusive) is equal to 320 x 10 = Bt3,200.

- An investor buys 25 contracts of S50Z11 via offline trading so the commission fee (VAT exclusive) is equal to 250 x 25 = Bt6,250.

- An investor buys 25 contracts of S50Z11 via Internet trading so the commission fee (VAT exclusive) is equal to 230 x 25 = Bt5,750.

|